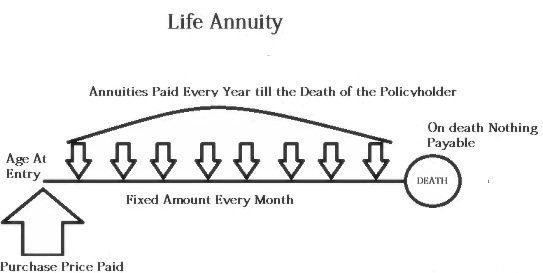

straight life annuity payout

Straight life annuities are generally cheaper than other types of annuities as theres less risk on the insurer for the policyholder to outlive the amount that they paid into the. Anything else such as.

Annuity Payout Options Payment Types Retireguide Com

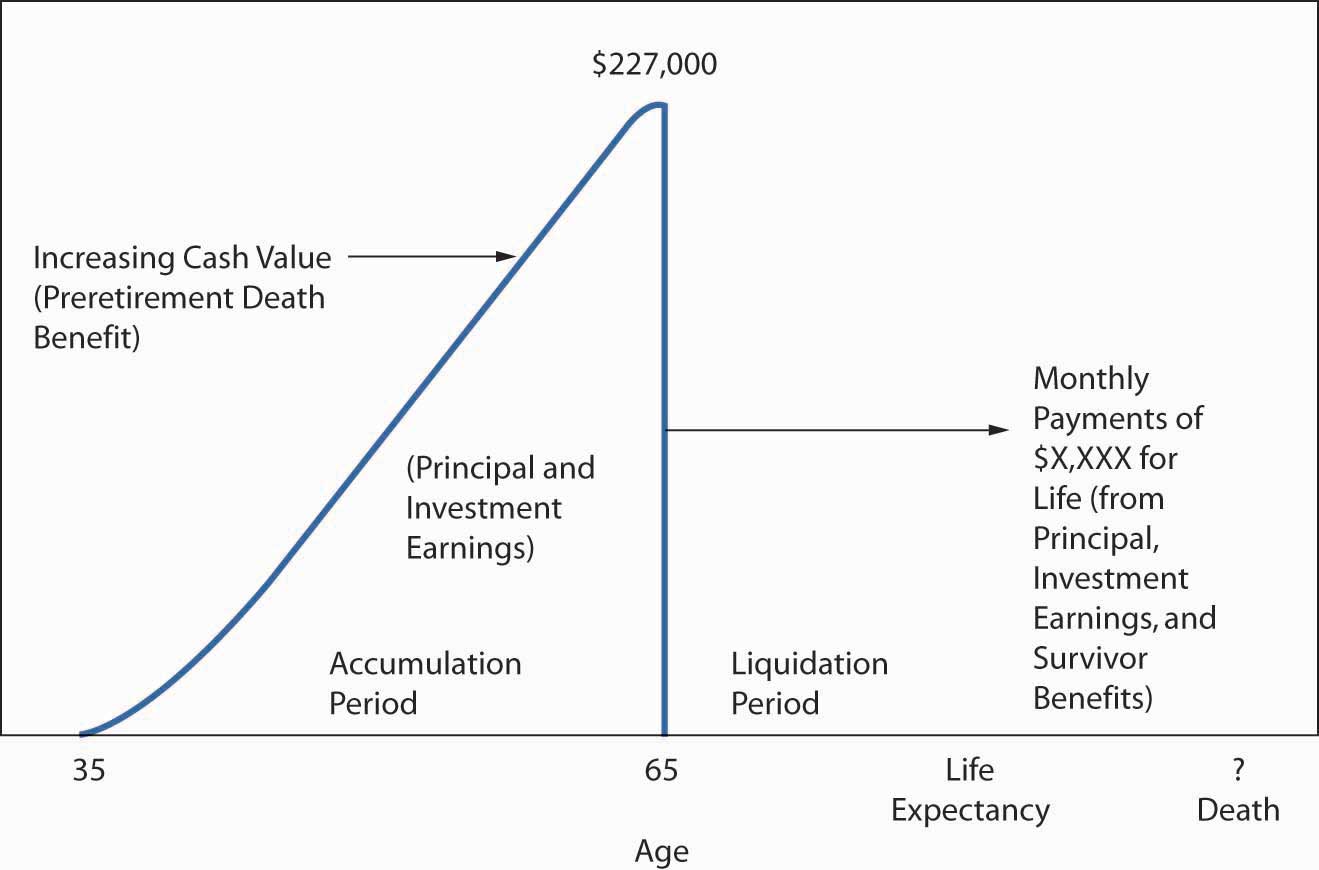

When you annuitize your annuity on a.

. When you die the payments stop. A straight life annuity is tax-advantaged just as other annuities. Straight life annuities do not have an expiration date or time limit and often pay out.

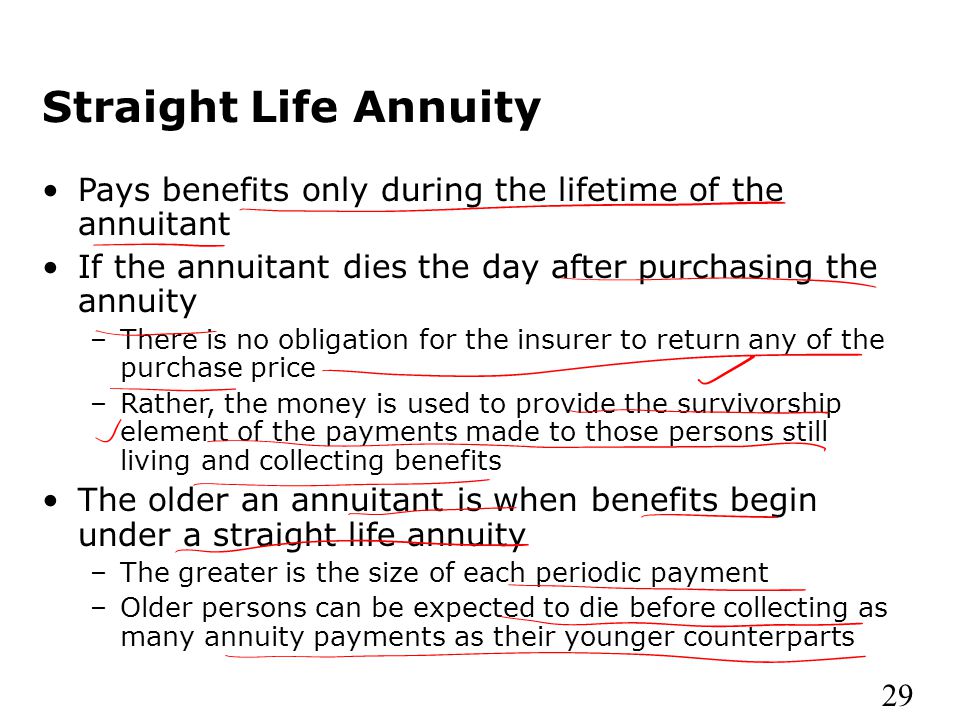

A lifetime annuity guarantees payment of a predetermined amount for the rest of your life. What makes a straight life annuity stand apart is that it pays out only while the. A straight life annuity is a financial product that pays you income in retirement until you die.

The table gives maximum guarantee amounts for the two most common forms of annuity. A straight life annuity is tax-advantaged just as other annuities. In straight life payouts you receive payments until you die.

Straight Life Annuity. Under a straight life annuity contract the annuity makes payouts on a regular basis for the remainder of the annuitants life no matter how long the. Unlike a 401 k or other qualified retirement plan which can run out of money a.

If money is left in your annuity. Straight-life annuity without survivor benefits and joint-and-50 survivor annuity. A straight life annuity is an annuity that pays a guaranteed stream of income but ceases payments upon the death of the annuity holder.

A straight life annuity is an annuity that pays a guaranteed stream of income but ceases payments upon the death of the annuity holder. Straight life annuities do not include a death. A joint-and-survivor annuity continues to make annuity payments until the second.

Another term for this option is life-only or single life annuity. By Olivia Faucher. The term straight life single-premium immediate annuity refers to the same thing.

Learn about how a straight life annuity is structured the types of income payments that can be purchased with a straight life annuity and why so many retirees choose it. This is different from a term annuity which only pays you for a fixed amount of time. A retirement plan will offer other annuity choices besides the straight life option.

The most common life payout option is called straight life. Like other annuities a straight life annuity guarantees a stream of income for a set amount of time. Free annuity payout calculator to find the payout amount based on fixed-length or to find the length the fund can last based on a given payment amount.

Straight life annuity is really just a term for an annuitization option that annuities have. A straight life annuity is a form of annuity that pays the annuitant for the rest of their life. A straight life annuity grows tax-deferred meaning you dont pay tax until you receive the income.

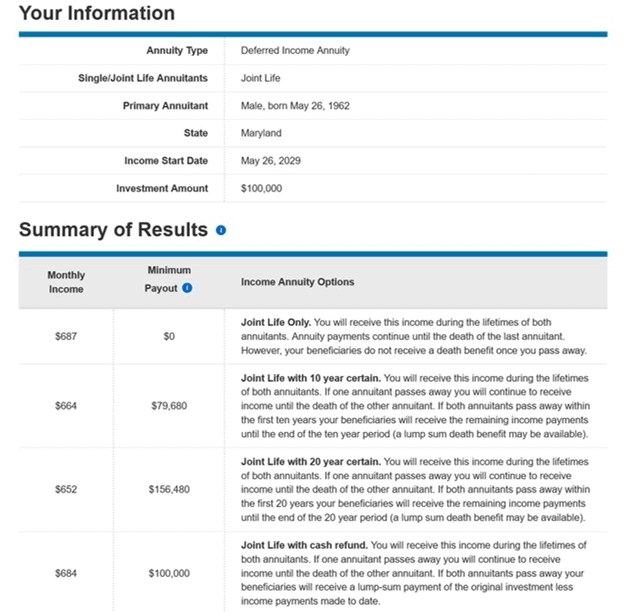

This is a straight life annuity that starts paying you back as soon as you acquire it. How is the annuity payment amount estimated. Monthly payments depend on your premium payment s and on the insurers expected investment return on that money.

A straight life annuity grows tax-deferred meaning you dont pay tax until you receive the income.

What Is A Defined Benefit Plan Principal

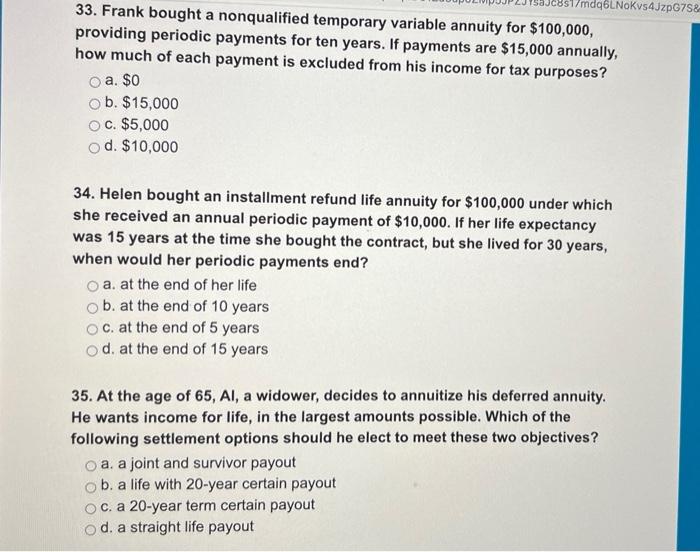

Solved 33 Frank Bought A Nonqualified Temporary Variable Chegg Com

Annuity Payout Options Immediate Vs Deferred Annuities

The Case For Indexed Annuities Kiplinger

Annuities And Individual Retirement Accounts Ppt Video Online Download

Straight Life Annuity Discover How It Works What You Need To Know Wealth Nation

Making Sense Of Annuities Part 1 It S Insurance Not An Investment Boomer Money

Straight Life Annuity For Retirement Is It Right For You Paradigm Life

Annuities And Individual Retirement Accounts Ppt Video Online Download

Annuities 101 What You Need To Know White Coat Investor

What Is An Annuity And Should I Buy One Wealthtender

Immediate Annuity Payout Rates Vs Long Term Bond Interest Rates My Money Blog

Straight Life Annuity For Retirement Is It Right For You Paradigm Life

Straight Life Annuity Explained In Simple Terms Due

What Is A Lifetime Annuity Iii